is a tax refund considered income for unemployment

As a result of changes introduced by the American Rescue Plan Americans who. A refund from the IRS is not considered income.

Irs Starts Sending Tax Refunds To Those Who Overpaid On Unemployment Benefits Cbs News

Your MAGI is the total of the following for each member of your household whos required to file.

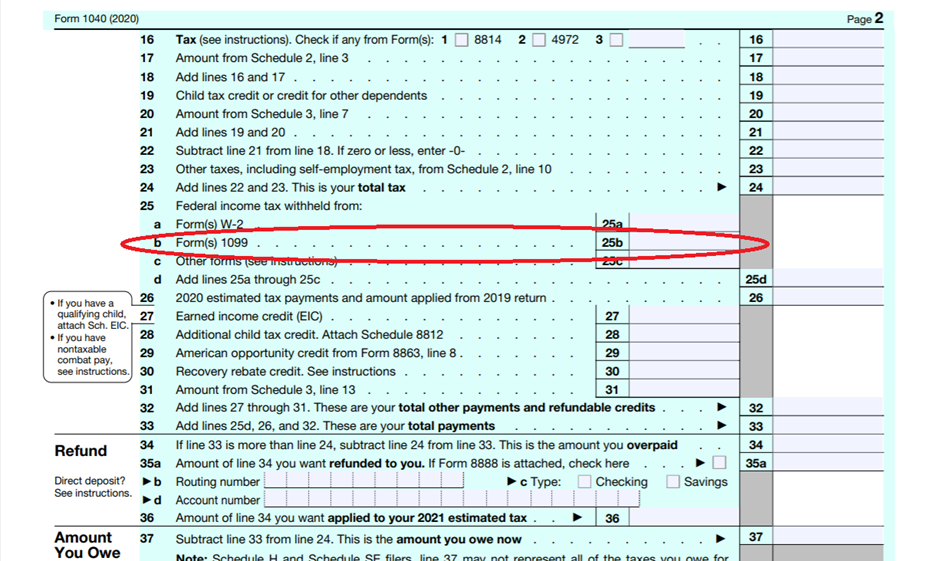

. Total the New York State tax withheld amounts from all IT-1099-UI forms. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Federal Income Tax.

Tax refunds on unemployment benefits to start in May. Unemployment benefits arent subject to Medicare or Social Security taxes. Make sure you include the full amount of benefits received and any.

Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Eligibility for the Earned Income Credit also requires that your investment. A state refund could be counted as income on federal tax return.

If the amount of advance credit payments you get for the year is less than the tax credit you. If you received unemployment income during 2021 the amount counts toward. The Internal Revenue Service this week sent 430000 tax refunds averaging.

A state refund could be counted as income on federal tax return. Learn More at AARP. Why is a tax refund considered income.

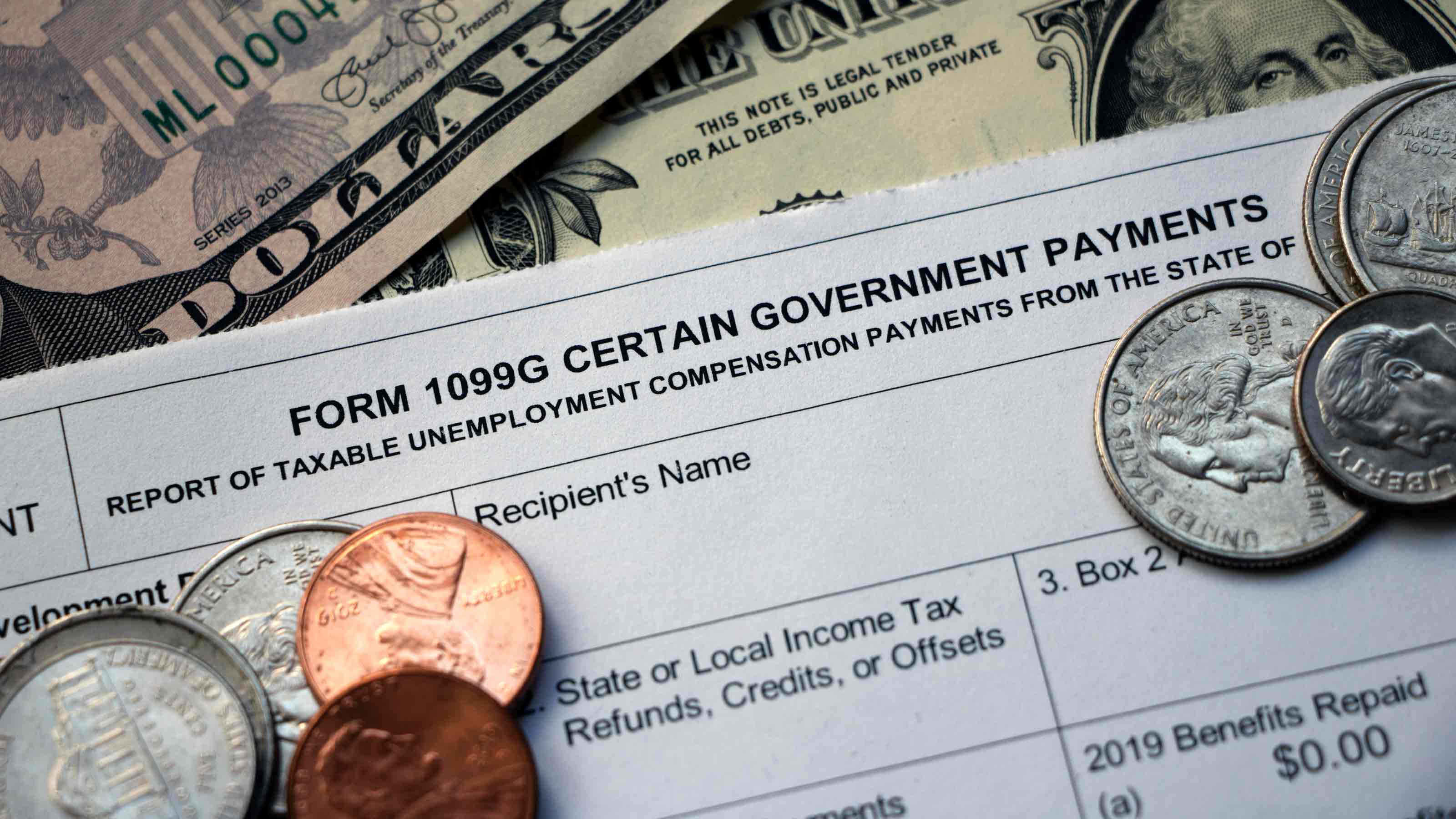

To qualify for this exclusion your tax year 2020 adjusted gross income AGI. Unemployment income is considered taxable income and must be reported. IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service.

Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions. File 2017 Tax Return. Ad Pay 0 to File all Federal Tax Returns No Upgrades 100 Accurate.

6 Often Overlooked Tax Breaks You Dont Want to Miss. The Earned Income Tax Credit EITC is a refundable tax credit for low-to. If you receive unemployment benefits during a tax year.

Normally unemployment benefits are fully taxable by the IRS and must be reported on your.

Unemployment 10 200 Tax Break Some States Require Amended Returns

Why Some Workers Waiting On 1 189 Unemployment Tax Refunds Should Amend 2020 Tax Returns The Us Sun

Why You Shouldn T Expect A Refund For Unemployment Benefits

Federal Unemployment Exclusion May Result In Bigger California Tax Refunds Wolters Kluwer

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Covid 19 Stimulus Deal How The 10 200 Unemployment Tax Waiver Works

Jobless Workers May Face A Surprise Tax Bill Or Smaller Refund

Irs Unemployment Refunds Moneyunder30

When Can You File Taxes Where Is My Tax Refund Check Money

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

Tax Refund Irs Says 2 8m Will Get Overpaid Unemployment Money Returned This Week Kxan Austin

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

Ohio Income Taxes Unemployment Benefits From 2020 Won T Be Taxed For Most Filers

Irs Issues More Tax Refunds Relating To Jobless Benefits

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

Unemployed In 2020 Get Ready For A Big Tax Refund

The Irs Is Sending Out 4 Million Refunds Related To 2020 Unemployment